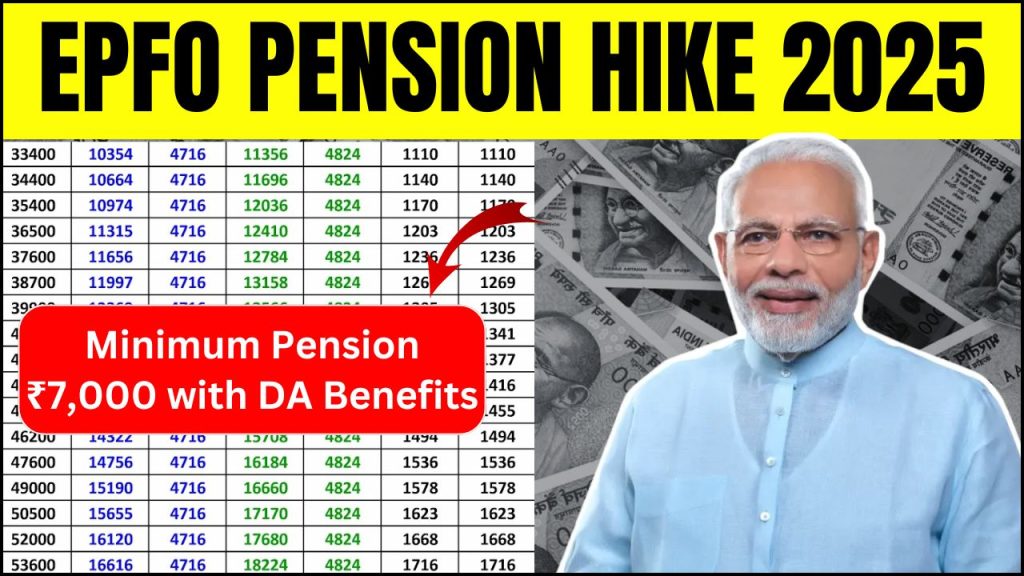

In a historic and much-needed move, the Indian government has approved a big hike in the minimum monthly pension under the Employees’ Pension Scheme (EPS). Starting in 2025, all eligible pensioners under EPFO will now receive at least ₹7,000 per month, up from the earlier ₹1,000. This decision will directly benefit over 6.2 million retirees across the country.

What makes this reform even more special is the addition of Dearness Allowance (DA) for the first time in the EPS. This means pensioners will now receive extra money to help manage the rising cost of living, something they didn’t get before.

Why This Pension Hike Matters

The old pension amount of ₹1,000 had not changed since 2014. Over the last 10 years, the prices of food, medicines, transport, and electricity have gone up a lot. Many retired workers—especially those from low-income jobs—found it very difficult to live on just ₹1,000 per month.

Some had to borrow money or depend on family just to buy medicine or pay rent. Pensioners and labor groups had been asking for an increase for years. This 2025 hike is not just a change in numbers—it’s a lifeline for millions of elderly citizens.

What’s New in the 2025 Pension Reform?

Let’s take a quick look at the key changes:

| Feature | Before 2025 | After 2025 |

|---|---|---|

| Minimum EPS Pension | ₹1,000/month | ₹7,000/month |

| Dearness Allowance (DA) | Not available | Included and linked to inflation |

| Inflation Adjustment | No | Yes |

| Beneficiaries | 6.2 million | 6.2 million |

This change brings EPS more in line with other government pensions that already include DA and inflation-based updates.

What is Dearness Allowance and Why Is It Important?

Dearness Allowance (DA) is an extra amount added to the pension to help fight inflation. As prices rise, so does the DA. This keeps the real value of your pension from falling.

So far, only central and state government pensioners received DA. Now, for the first time, EPFO pensioners will get DA too. This is a big step toward fairness and economic security for all retirees, not just government employees.

How This Helps Pensioners and Their Families

The ₹7,000 monthly pension—plus DA—means retirees can now live with more dignity. They can afford better food, medicine, and maybe even save a little. More importantly, they will not need to depend as much on their children or relatives.

This also benefits families, especially in middle- and lower-income households. With less financial pressure on working members, overall household stress goes down.

And when pensioners spend this money in their local areas—on groceries, transport, medicines, or services—it helps boost the local economy, especially in small towns and villages.

The Challenges That Remain

While this reform is a huge win, some challenges still exist.

- Many pensioners, especially in rural areas, don’t know how to access their benefits. They may not use smartphones or know how to update their information online.

- Delays in pension payments due to paperwork or technical issues can still cause hardship.

- Language barriers and complicated procedures can make it tough for elderly people to get what they’re entitled to.

To fix this, the government and EPFO need to run awareness campaigns, provide local language support, and simplify the process for claiming the revised pension.

What Pensioners Are Saying

Since the announcement, pensioners across India have expressed relief and happiness.

- “With ₹7,000, I can finally afford my medicines without borrowing money,” says Rajeshwar Prasad, a 72-year-old from Bihar.

- “This is the first time I feel seen and heard. I used to skip meals some days—now I can eat properly,” shares Rekha Kumari, a widow from Madhya Pradesh.

These stories show how much impact this one change can make in someone’s daily life.

Summary of Key Benefits

Here’s a quick look at what this pension reform brings:

- ₹7,000 per month minimum pension (previously ₹1,000)

- Dearness Allowance added, adjusted twice a year

- Helps over 6 million retirees

- Closer parity with central and state government pensions

- Likely to improve economic activity in rural areas

What Can Be Done Next?

While this is a great beginning, there’s room for more progress. Experts suggest a few more upgrades to make the pension system even better:

| Proposed Idea | Possible Benefit |

|---|---|

| Voluntary top-up by workers | Bigger pensions after retirement |

| Pension + Health scheme combo | Help with medical costs |

| Central dashboard in local languages | Easy access and tracking for everyone |

| Awareness drives in rural areas | More pensioners get what they deserve |

Making the pension system easier to use, especially for the elderly and those who speak regional languages, is key to long-term success.

A New Era for Retirees

The EPFO Pension Hike 2025 marks a turning point in India’s retirement policy. After years of waiting, retirees now have a support system that respects their contribution to the country. With ₹7,000 as the base pension and DA to fight inflation, they can now live with a bit more comfort and a lot more dignity.

This reform is a powerful reminder that a nation’s progress is measured not just by its GDP, but by how it treats those who built its foundations. Millions of pensioners will now step into a more secure and hopeful future—and that’s something worth celebrating.